Let's imagine a shopper is excited about your product. They add it to their cart, reach the payment step... and suddenly pause. Their budget is too tight or payday is still a week away. So, instead of buying now, they leave.

This is exactly why Buy Now, Pay Later (BNPL) payment plans are exploding in popularity—it give shoppers the flexibility they crave.

As a store owner, you can seamlessly integrate BNPL into your WooCommerce business and offer your customers the opportunity to pay less upfront for your products. This is especially useful when they have a tight budget, while it also drives sales in your store.

Buy now pay later (BNPL) accounted for 5% of global eCommerce transaction volume in 2022 and is expected to grow at a CAGR of 16% between 2022 and 2026. [FIS Global Payments Report 2023]

You can easily utilize the popularity of this BPNL payment method and integrate it with WooCommerce to grow the sales of your online store.

In this post, we’ll help you understand everything about the buy now, pay later payment method and how to enable it in WooCommerce.

Setting up BNPL options won't make sense if you don't have high-converting elements on your checkout page. Click below to create and optimize a buying flow and grow your business!

Here's a quick video tutorial on setting up buy now pay later methods in WooCommerce:

What is WooCommerce Buy Now Pay Later (BNPL)?

Buy Now Pay Later is a payment method that lets customers make purchases and pay for them over time, typically in installments.

With BNPL, customers can buy products and services immediately, even when they are under budget constraints, and spread out the cost into smaller, more manageable payments.

For example, a user can buy a product worth $100 by paying $25 in installments for 4 months.

This allows customers to afford the things they want with easily manageable installments.

It’s highly popular among shoppers. As per Juniper Research, an estimated 360 million people use BNPL globally. It’s expected that there will be 900 million BNPL users by 2027 (an increase of 157%).

Buy now pay later is an alternative to traditional credit cards; however, it typically involves minimal to no interest, based on the shopper’s credit. At the same time, credit cards levy too much interest on payment plans.

You can easily integrate BNPL payment gateways into WooCommerce to increase conversions, generate more sales and foster customer loyalty.

That’s why there are now 200+ global providers that offer installment loans.

Some popular BNPL payment gateways include Afterpay, Affirm, Klarna, PayPal Credit, Perpay, Zip, and Sezzle.

Let's now understand how these BNPL payment gateways work.

How WooCommerce Buy Now Pay Later Payment Plans Work?

Buy Now, Pay Later is the fastest-growing eCommerce payment method and is projected to reach $3.7 trillion by 2030.

Integrating the BNPL payment gateway with WooCommerce can revolutionize your business.

Here’s a quick breakdown of how WooCommerce buy now pay later works:

Step 1: Integration with BNPL operators - Integrate WooCommerce with BNPL service providers such as Afterpay, Affirm, Klarna, etc. You can easily do it with different plugins (which we’ve listed below in this post).

Step 2: Checkout process - When a customer adds items to their cart and proceeds to checkout, they are provided with an option to choose a BNPL payment plan.

Step 3: Selection of BNPL payment option - To opt for a buy now pay later payment scheme, customers need to select this payment option on the WooCommerce checkout page.

Step 4: Purchase approval - The BNPL provider will direct shoppers to a quick assessment of their creditworthiness or eligibility based on different factors, such as credit history, transaction amount, eligible items, etc. Once approved, shoppers can proceed with the purchase.

Step 5: Payment schedule - Instead of paying the full amount upfront, shoppers can select a payment plan over a set period. The interest on these payment plans varies as per the shopper’s credit (interests usually vary from 0% to 36% APR). After selecting a plan, the process moves to the payment processing stage.

Step 6: Payment processing - The BNPL provider handles the processing and collection of the payment from the customer based on the agreed-upon schedule.

Step 7: Merchant receives the payment - Once the transaction is complete, the WooCommerce merchant receives the complete payment for the purchase from the BNPL operator. The merchant receives the full amount upfront, and the BNPL provider goes through the risk of collecting payments from the customer over time.

While BNPL services offer convenience and flexibility for consumers, it’s crucial to be mindful of the potential costs involved, such as interest rates.

Once you have all the numbers, it’s best to make an informed decision.

Why Offer Buy Now Pay Later in Your WooCommerce Store?

Offering Buy Now, Pay Later (BNPL) options in your WooCommerce store can benefit both merchants and customers.

- Increased sales: BNPL payment options can help attract more customers who can be enticed by the ability to spread out payments over time. This makes the purchase affordable and accessible, particularly for larger-ticket items.

- Improved conversion rates: By providing flexible payment options, you can significantly reduce abandoned carts and improve conversions. This is because customers are more likely to place their orders when they have the option to pay later.

- Enhanced customer experience: Offering BNPL options proves that you understand and cater to your customers’ preferences for flexible payment methods. This allows you to enhance your customers’ overall shopping experience and satisfaction.

- Competitive advantage: Offering WooCommerce buy now pay later in your store helps differentiate your store from competitors and attract customers who actively seek flexible payment solutions to buy their favorite products.

- Increased order value: The BNPL payment method encourages customers to buy additional items or upgrade to high-value products. Since they can spread out the cost over time, it leads to a higher average order value in your online store.

- Expanded customer base: The WooCommerce Buy Now Pay Later option appeals to shoppers who have financial restrictions to make purchases upfront but are willing to buy with the option of paying it later. This helps expand your customer base while increasing sales at the same time.

- Reduced risks of payment fraud: BNPL services utilize a combination of advanced technology, strict security measures, and collaboration with merchants to reduce the risk of payment fraud and provide a secure shopping experience to customers.

With BNPL, store owners can generate more sales and foster customer loyalty, encouraging repeat purchases. Additionally, customers enjoy the flexibility and convenience of making purchases without worrying about their budgets.

Top 4 Popular WooCommerce Buy Now Pay Later Payment Gateways

Here are some of the popular Buy Now, Pay Later payment gateways compatible with WooCommerce:

1. Klarna

Klarna is a Swedish fintech company founded in 2005 that provides flexible shopping experiences to 150 million active customers across 500,000+ merchants in 45 countries.

It allows payment options such as:

- Pay in 30 days

- Pay in 3 installments

- Pay installment plans of 6, 12, 24 and 36 months with flexible payments

You can use Klarna in Sweden, Norway, the U.S.A., United Kingdom, Switzerland, Australia, Belgium, Canada, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, Germany, Greece, France, Ireland, Austria, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, New Zealand, Poland, Portugal, Romania, Slovakia, Slovenia, and Spain

2. Affirm

Affirm is the leading buy now pay later option in the U.S. with 17.6 million users and $20.2 billion GMV annually.

Affirm only supports domestic transactions, which means you can only sell to customers within the same country as your business. For example, if your business is in the U.S., you can only offer Affirm to U.S. customers. If your business is in Canada, only Canadian customers can use it. You can't use Affirm for cross-border transactions.

Business and customer locations: United States and Canada

Here are the payment options that Affirm offers:

- 4 interest-free payments every two weeks (available as per shopper’s credit)

- Monthly installment plans such as 3, 6 and 12 months

The Affirm payment method is currently available in the United States of America and Canada.

3. Afterpay / Clearpay

Afterpay (also known as Clearpay in the UK) is an Australian fintech company founded in 2014 that has more than 5 million active consumers across 15,000+ merchants.

Afterpay and Clearpay only work for purchases within the same country. This means you can only sell to customers in the same region as your business.

Customer and business locations: United States, Canada, United Kingdom, Australia, and New Zealand

These are the payment options for Afterpay:

- 4 interest-free payment installments

- Monthly payment plans such as 3, 6, and 12 months

Stripe does not allow Buy Now, Pay Later (BNPL) options like Klarna, Affirm, and Afterpay for subscription-based products. These payment methods can only be used for one-time purchases in your store, not for recurring payments.

Make sure to refer to Stripe's official document to check BNPL payment methods including repayment options, payment restrictions, transaction limits, and more.

4. PayPal Credit

Known as “Bill Me Later”, PayPal Credit offers a reusable credit line into your PayPal account that allows shoppers to finance purchases online and make payments over time.

PayPal Credit is available just about anywhere PayPal is accepted. It is available in over 200 countries/regions and supports 25+ currencies.

Customers can pay 6 months of interest-free installments on any purchase over $99. However, interest will be charged to their account if they fail to pay the amount within 6 months from the date of purchase.

How to Enable Buy Now, Pay Later Payment Method in Your WooCommerce Store?

Follow this step-by-step guide to set up WooCommerce Buy Now Pay Later in your store.

Step 1: Install and activate the WooCommerce Stripe Gateway plugin

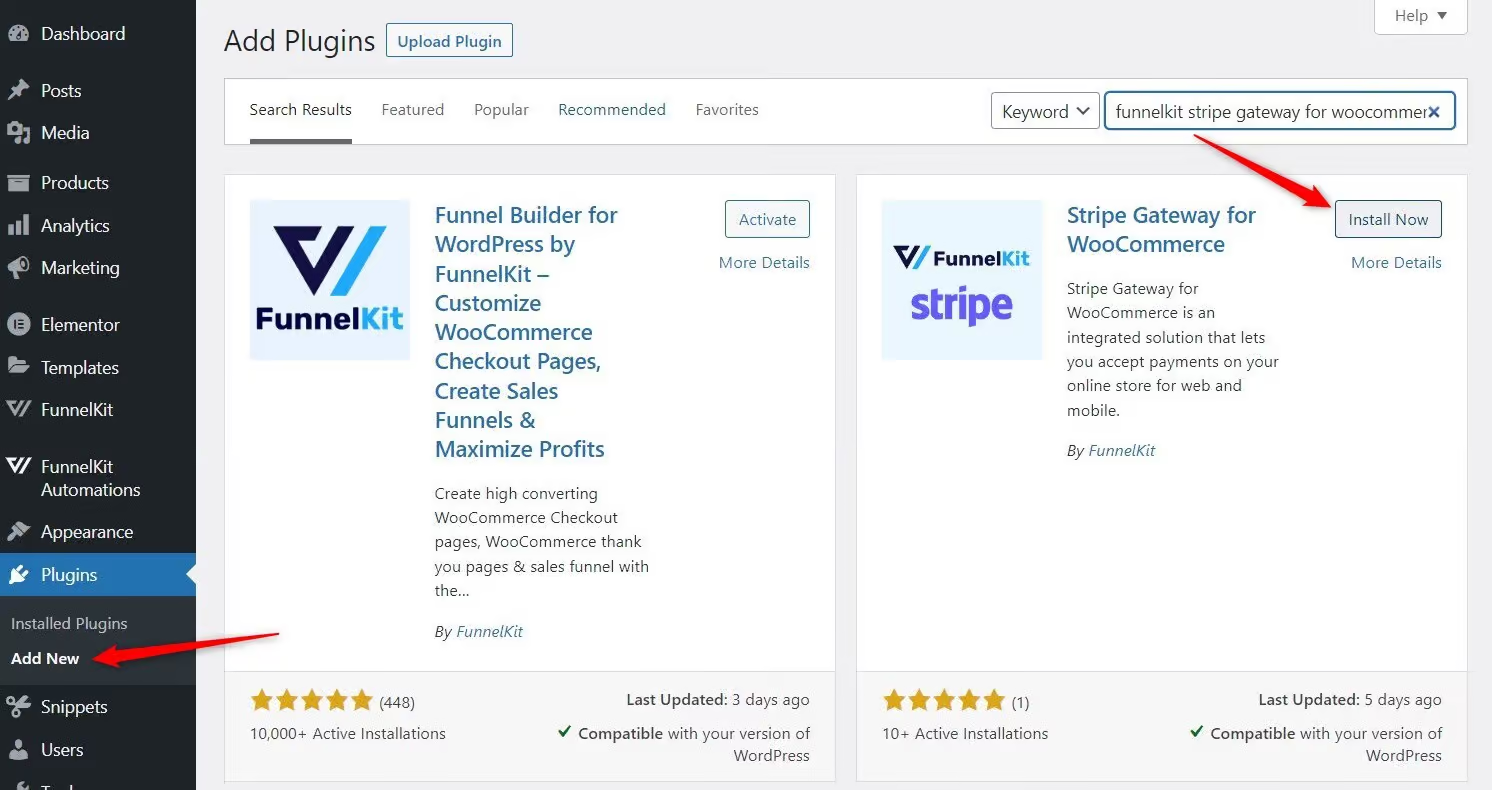

Navigate to Plugins ⇨ Add New Plugin on your WordPress dashboard and search for 'FunnelKit Stripe Gateway for WooCommerce'.

Install and activate the plugin as shown in the screenshot below:

Step 2: Connect the Stripe account to your WooCommerce store

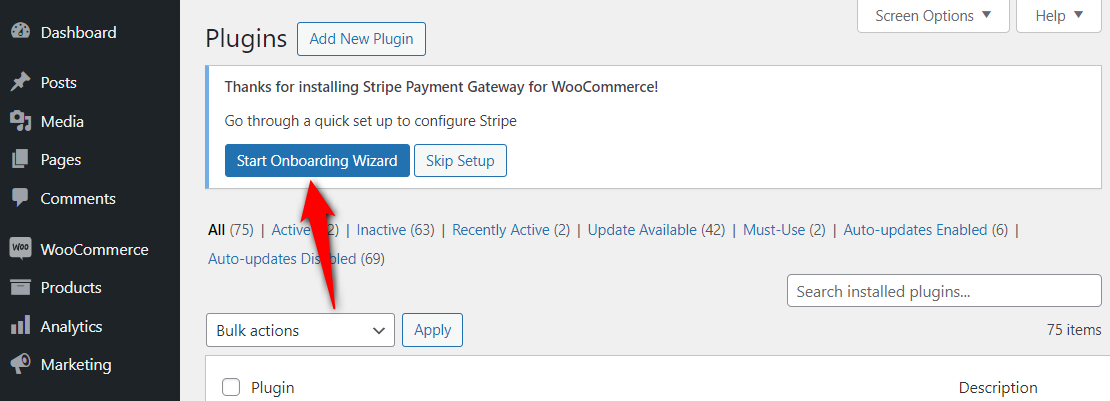

After installing the Stripe gateway plugin, click on the ‘Start Onboarding Wizard’ button.

It’ll direct you to the WooCommerce - Stripe connection process.

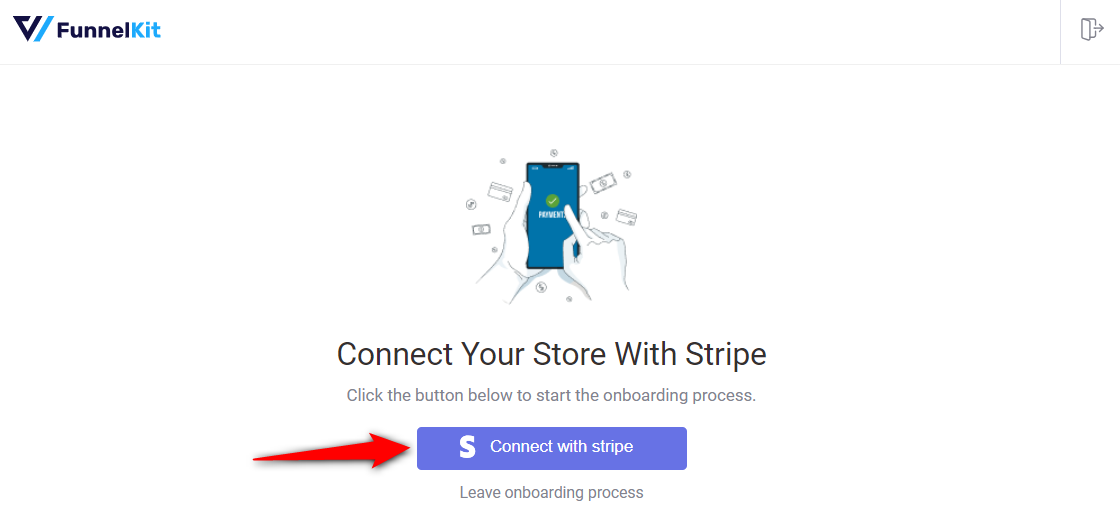

Here, hit the ‘Connect with Stripe’ button.

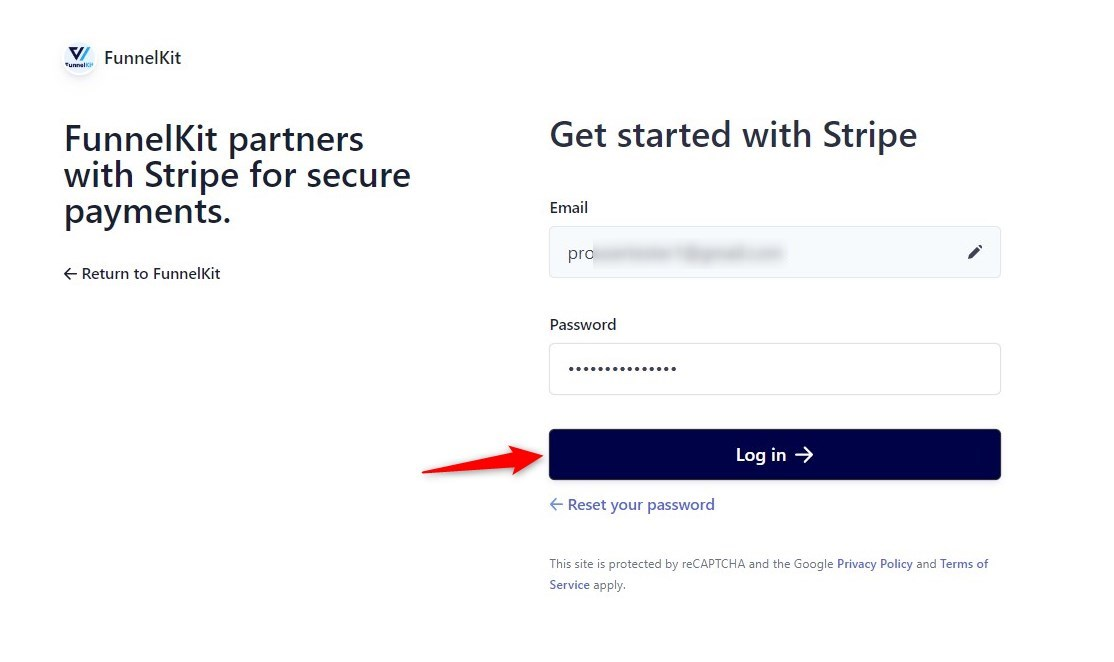

Sign in to your Stripe account with your login credentials, including your email address and password.

Verify your authorization by entering the 6-digit verification code sent to your registered phone number.

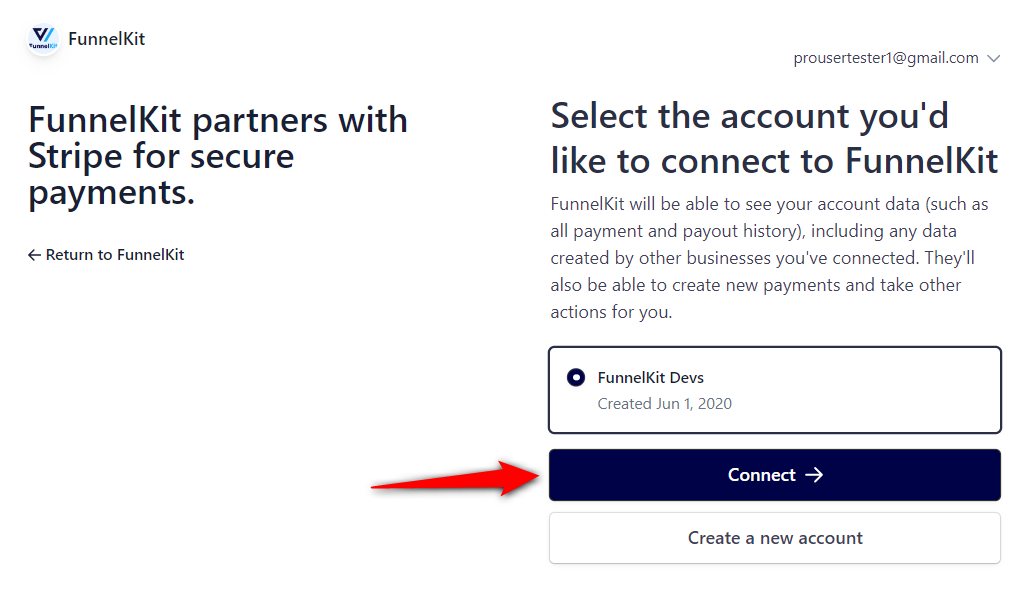

- Selecting your Stripe account

Confirm your Stripe account by selecting it and clicking on ‘Connect’.

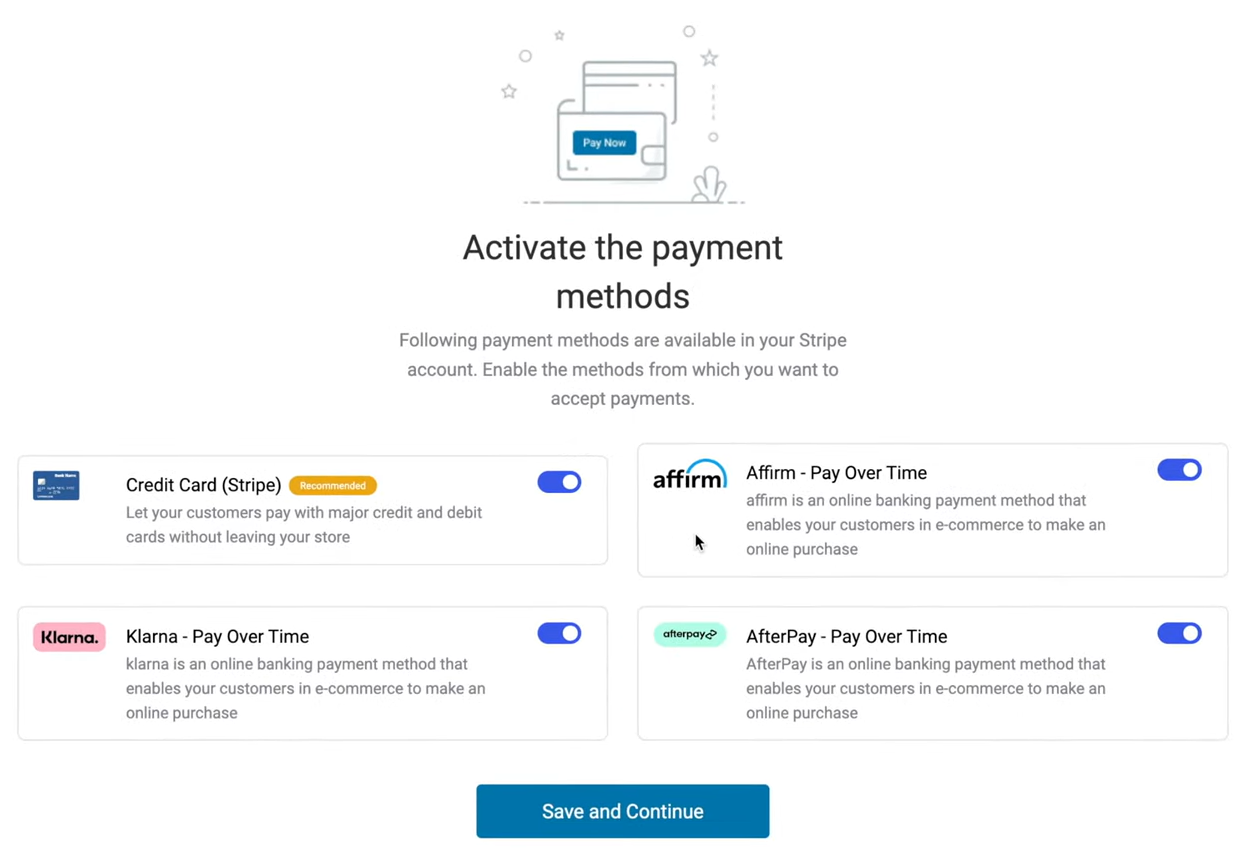

- Enabling the payment gateways

You’ll see different payment options on this screen.

Enable the Credit Card (Stripe) and any of your preferred WooCommerce Buy Now Pay Later payment gateways - Affirm, Klarna, or Afterpay.

Click on the ‘Save and Continue’ button.

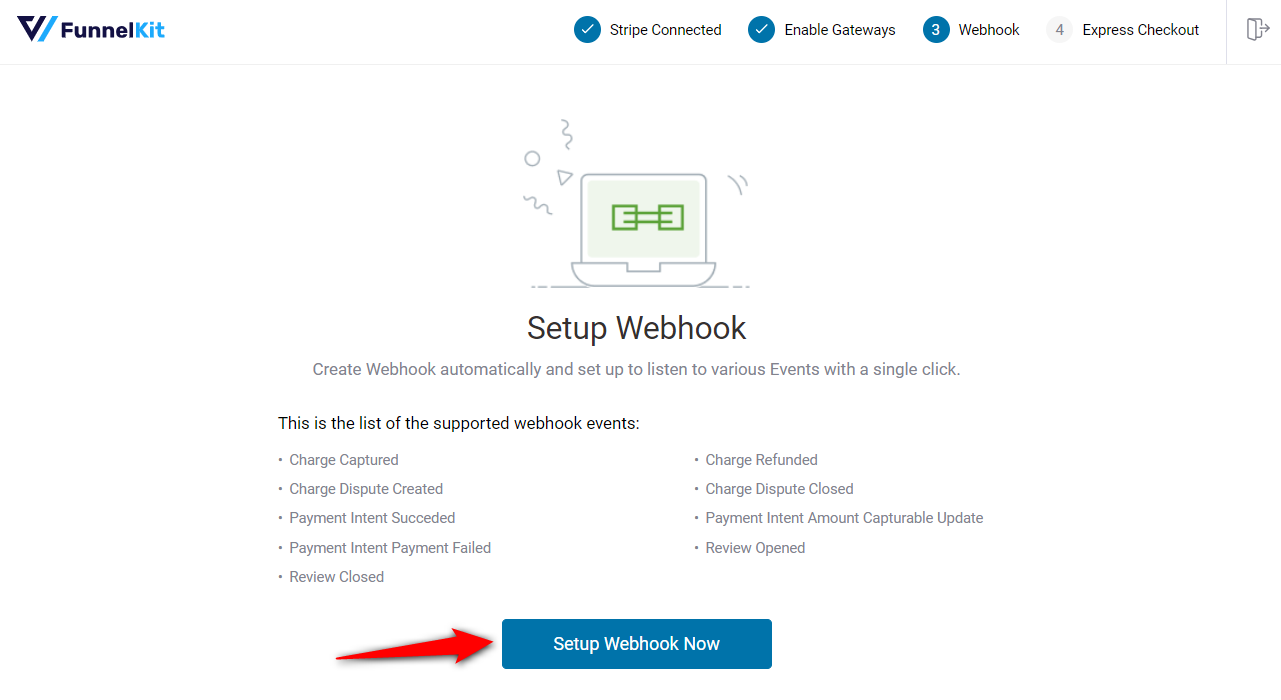

- Setting up your webhook

The Stripe gateway plugin automatically activates your webhooks to capture various events.

For that, hit ‘Setup Webhook Now’.

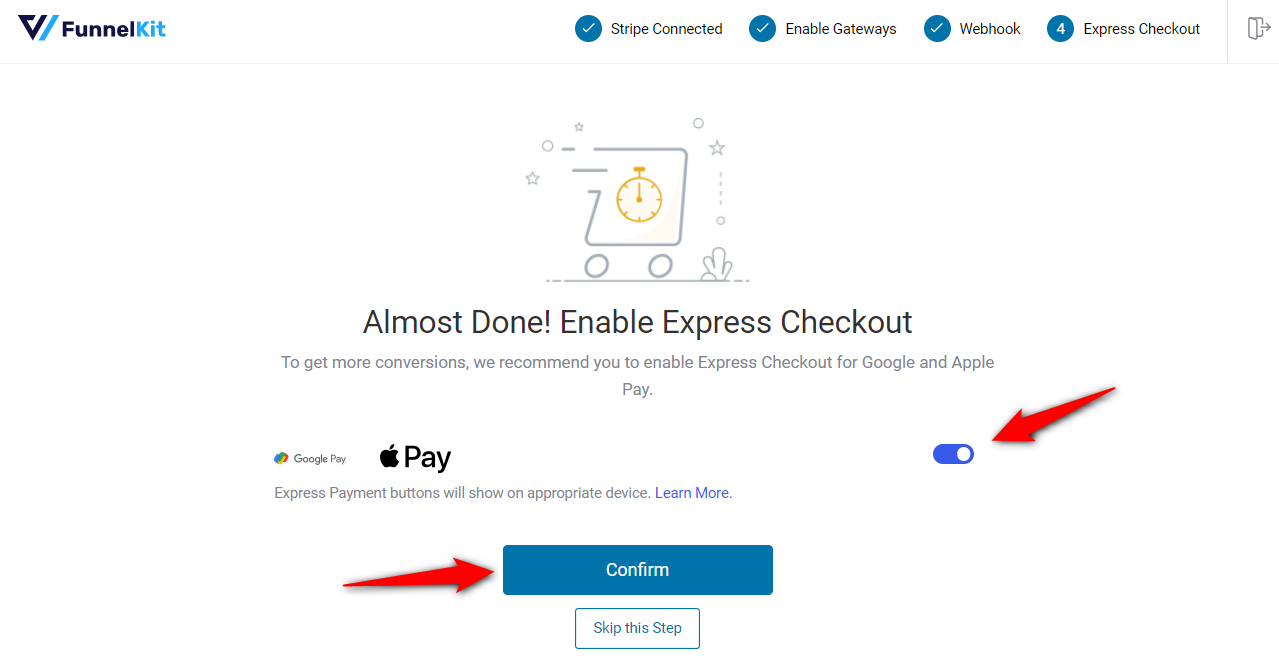

- Enabling the express checkout option

This option enables you to set up express checkout payments such as Google Pay and Apple Pay.

Turn the toggle to enable express checkout payments in your WooCommerce store.

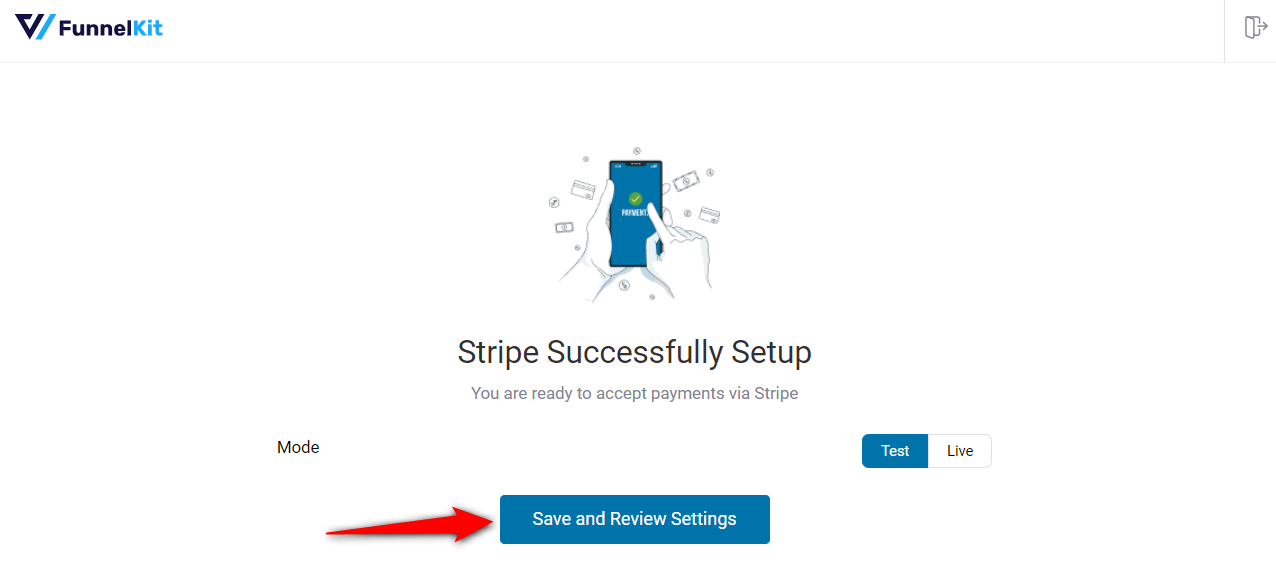

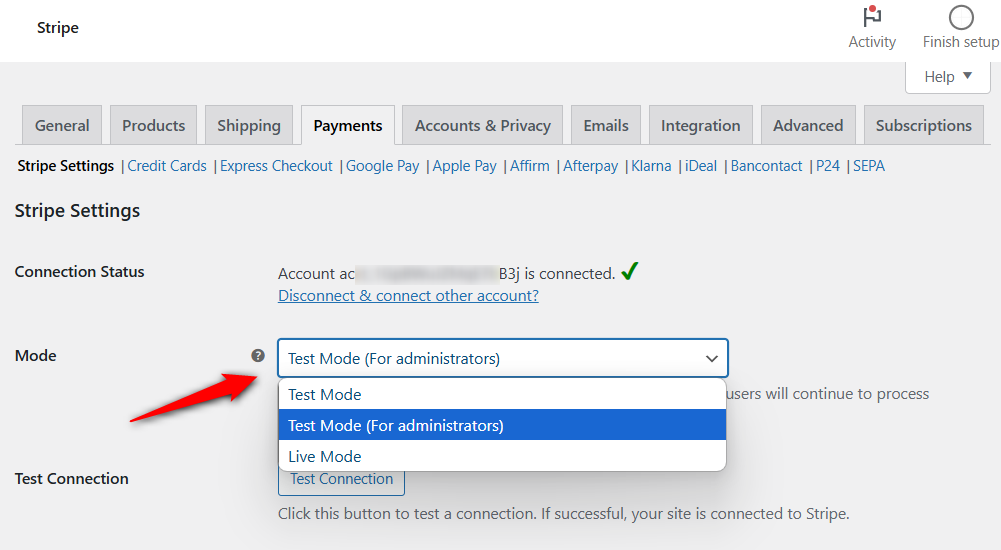

- Activating the live/test mode

Confirm the live or test mode you want to run on your WooCommerce store.

For now, we recommend turning on the ‘Test’ mode and clicking on ‘Save and Review Settings’.

This will successfully connect your Stripe account with your WooCommerce store.

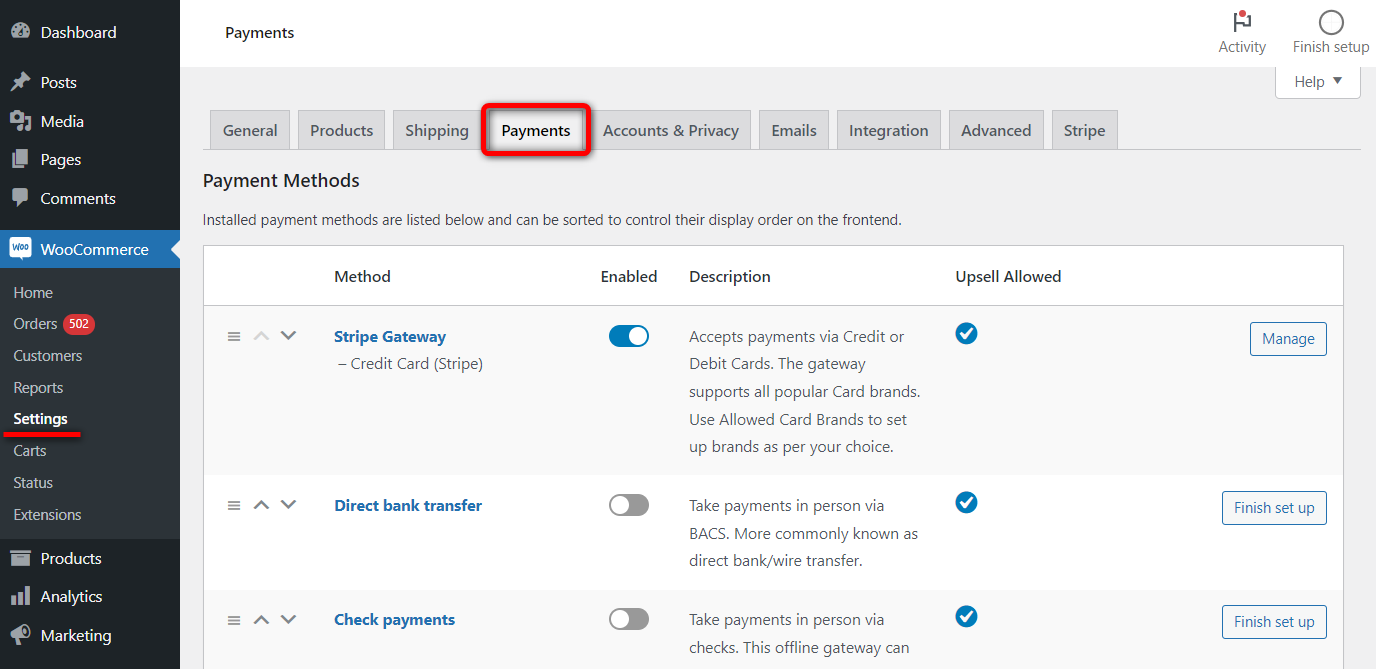

Step 3: Enable the WooCommerce Buy Now Pay Later payment gateway

Navigate to the WooCommerce Settings ⇨ Payments section.

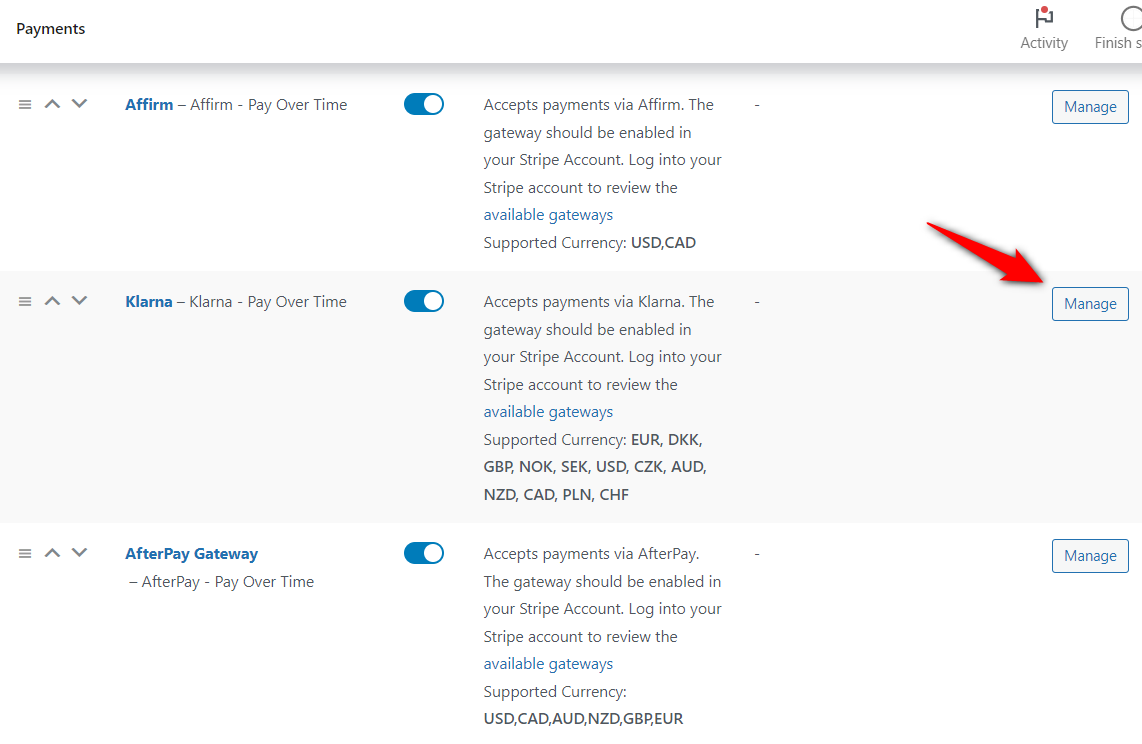

Scroll down to the section and you’ll find Affirm, Klarna and AfterPay.

Hit the ‘Manage’ button next to it.

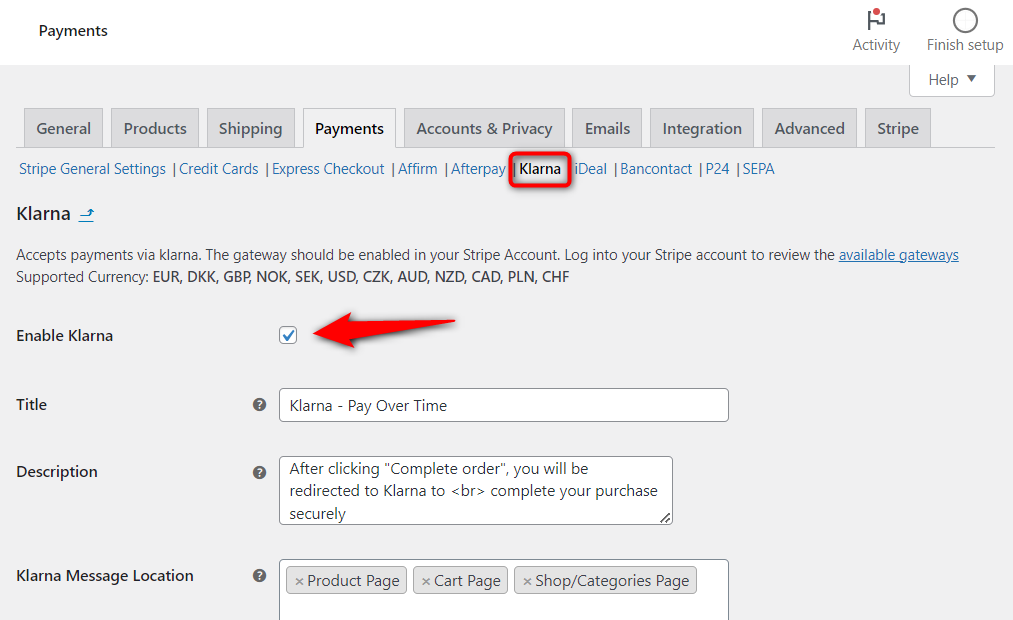

Next, check the option next to ‘Enable Klarna Payments’.

Please note that these options are the same for all the available WooCommerce BNPL payment gateways.

This will enable Klarna in your WooCommerce store.

Do the same for all Buy Now Pay Later payment options - Affirm, Afterpay and Klarna.

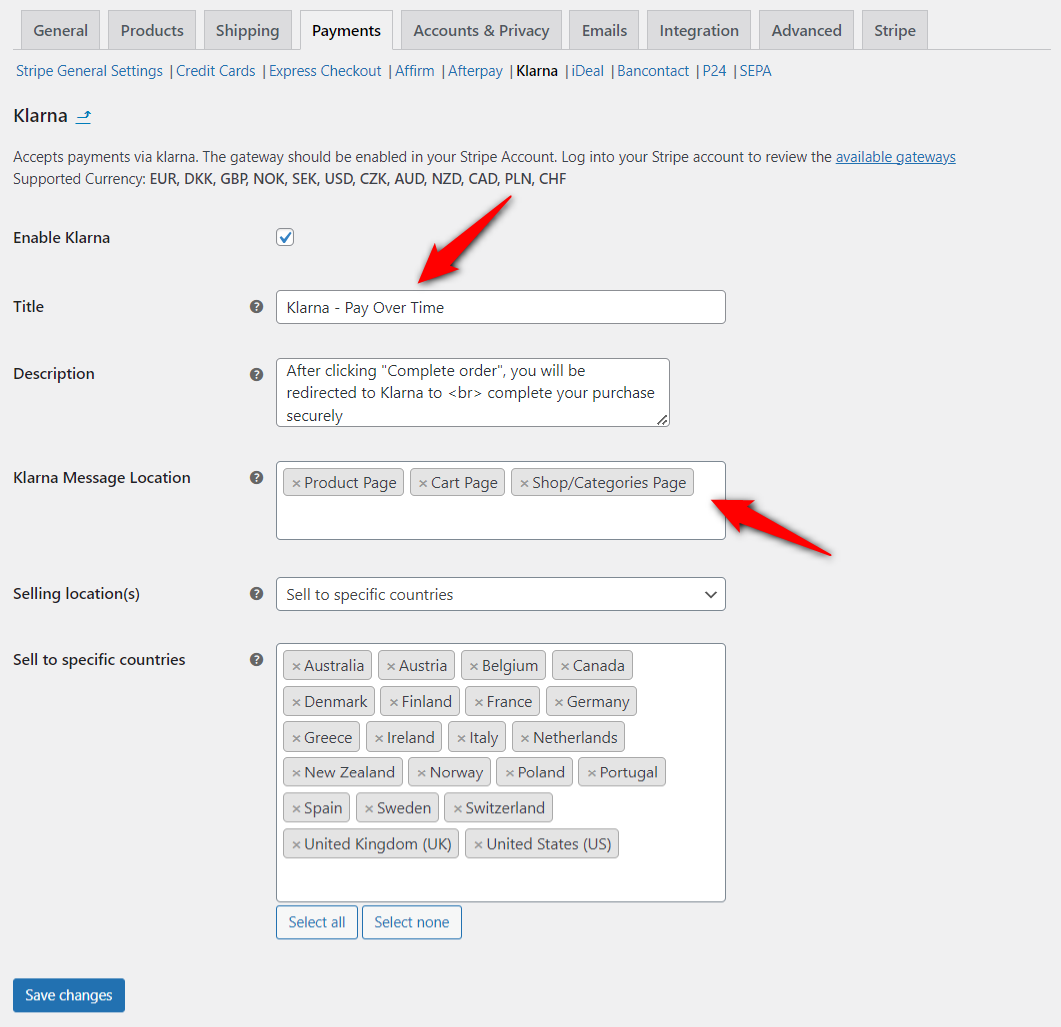

Step 4: Configure the WooCommerce Buy Now Pay Later payment option

Configure your Klarna BNPL payment gateway from the following options:

- Title - Enter the title of your WooCommerce BNPL payment method.

- Description - Write the description text that appears below the title of the Klarna payment option on the checkout page.

- Affirm/Klarna/Afterpay message location - Show the BNPL message location to different pages in your store such as product pages, cart page, category pages, etc.

- Selling location(s) - Set this payment option to include selling locations. By default, this option is set to sell to specific countries (recommended for BNPL payments).

- Sell to specific countries - List the countries where you want to offer the particular BNPL payment method. Please note that Klarna, Affirm, and Afterpay - all these gateways serve specific countries. We recommend that you not change the default countries listed here.

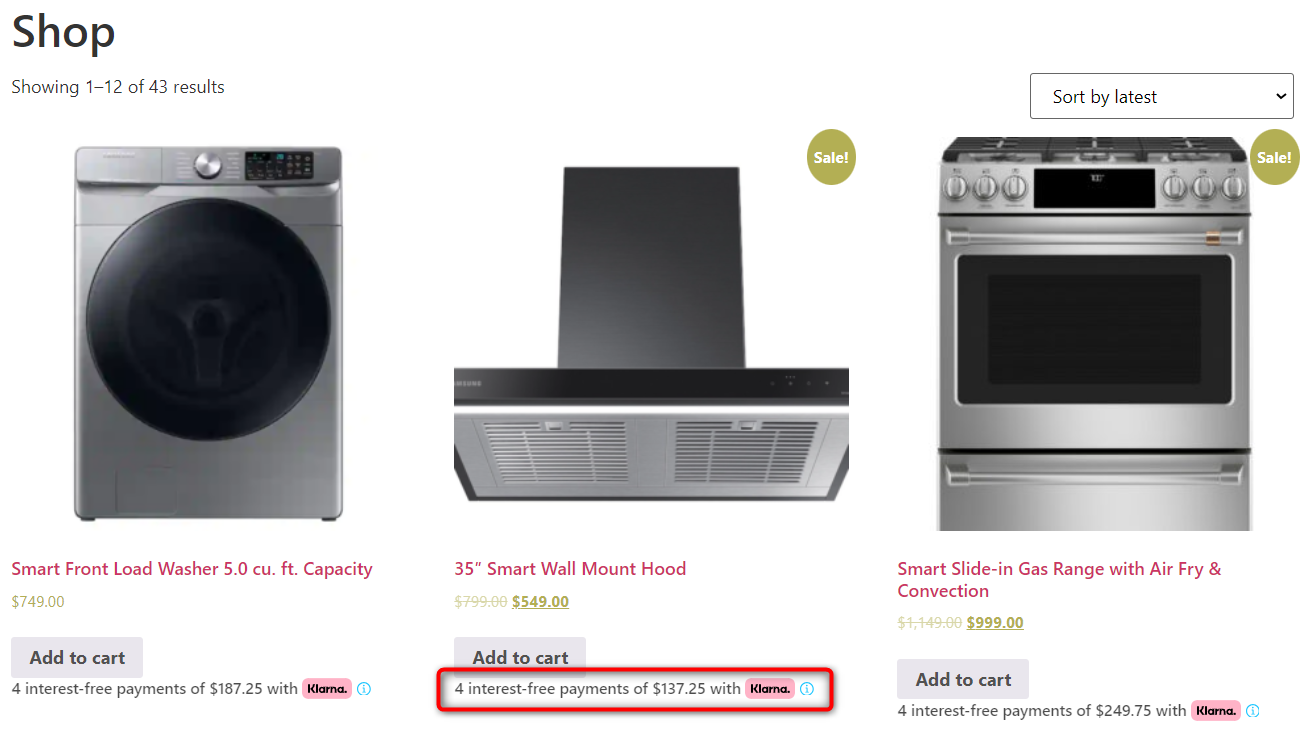

This is how the Klarna payment message appears on the shop or category page:

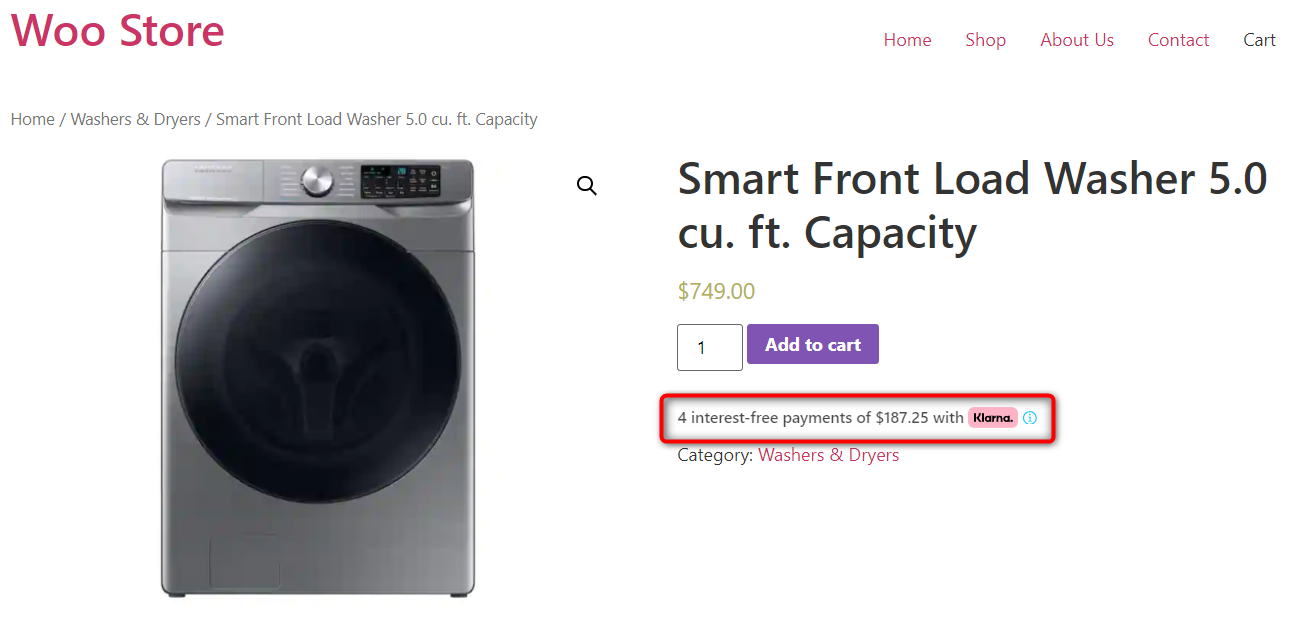

On the product’s page:

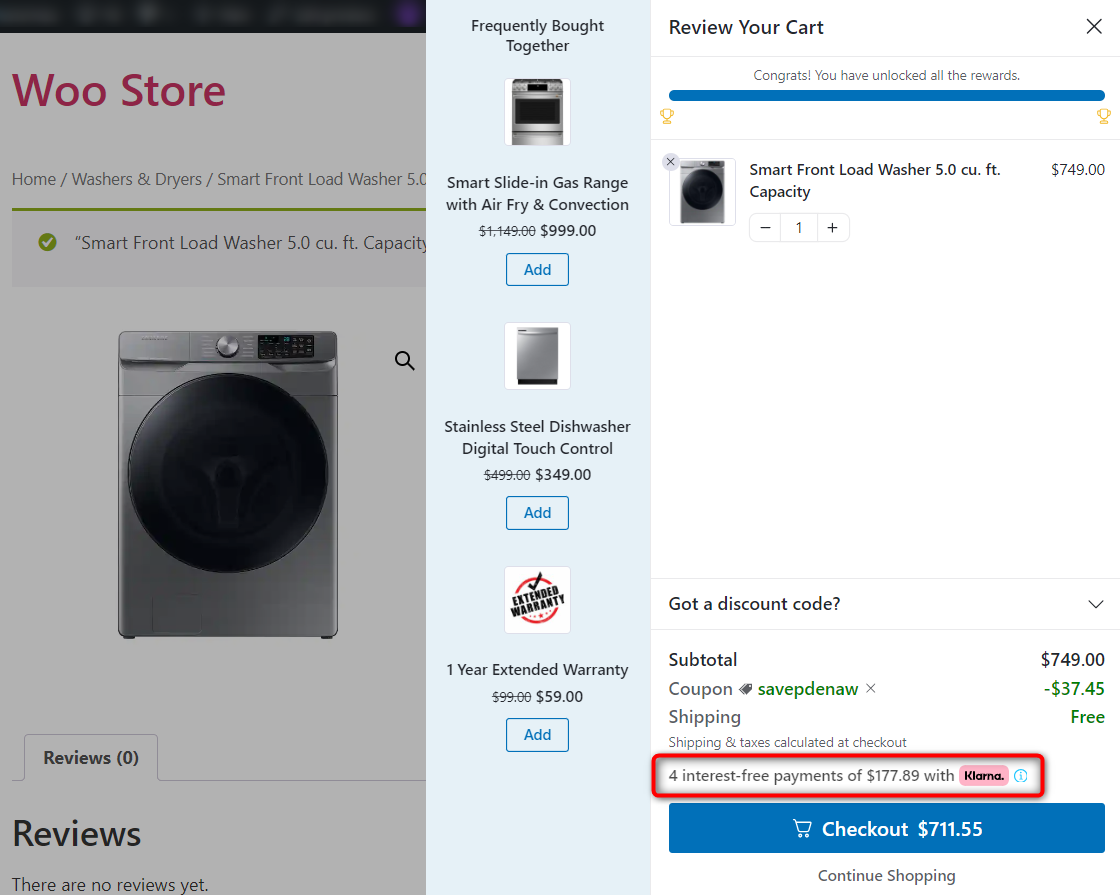

Inside the shopping cart:

You can skip the default redundant cart page and directly head to the checkout.

Witness the FunnelKit Cart’s sliding shopping cart, offer upsells inside the cart and provide cart discounts.

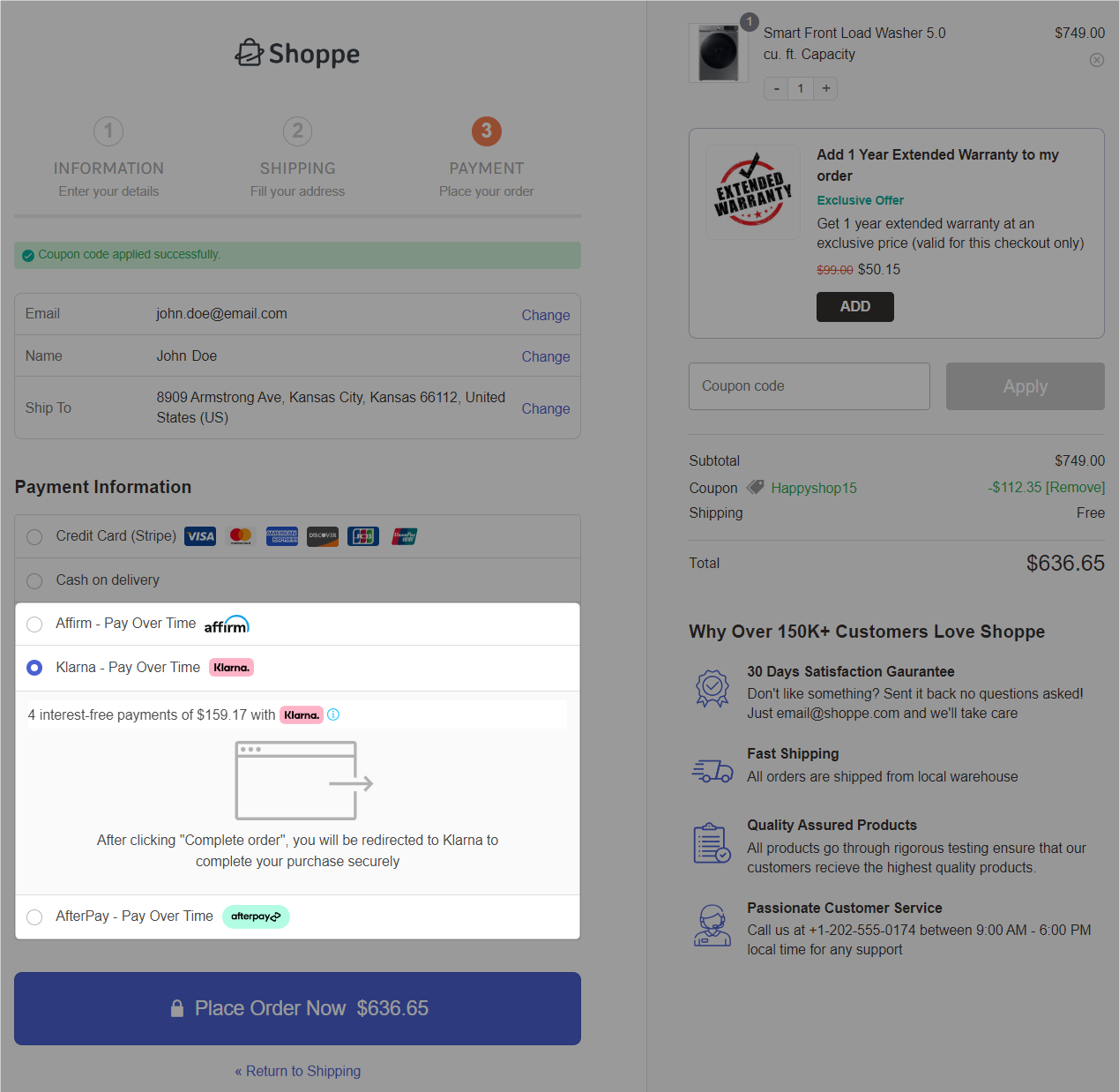

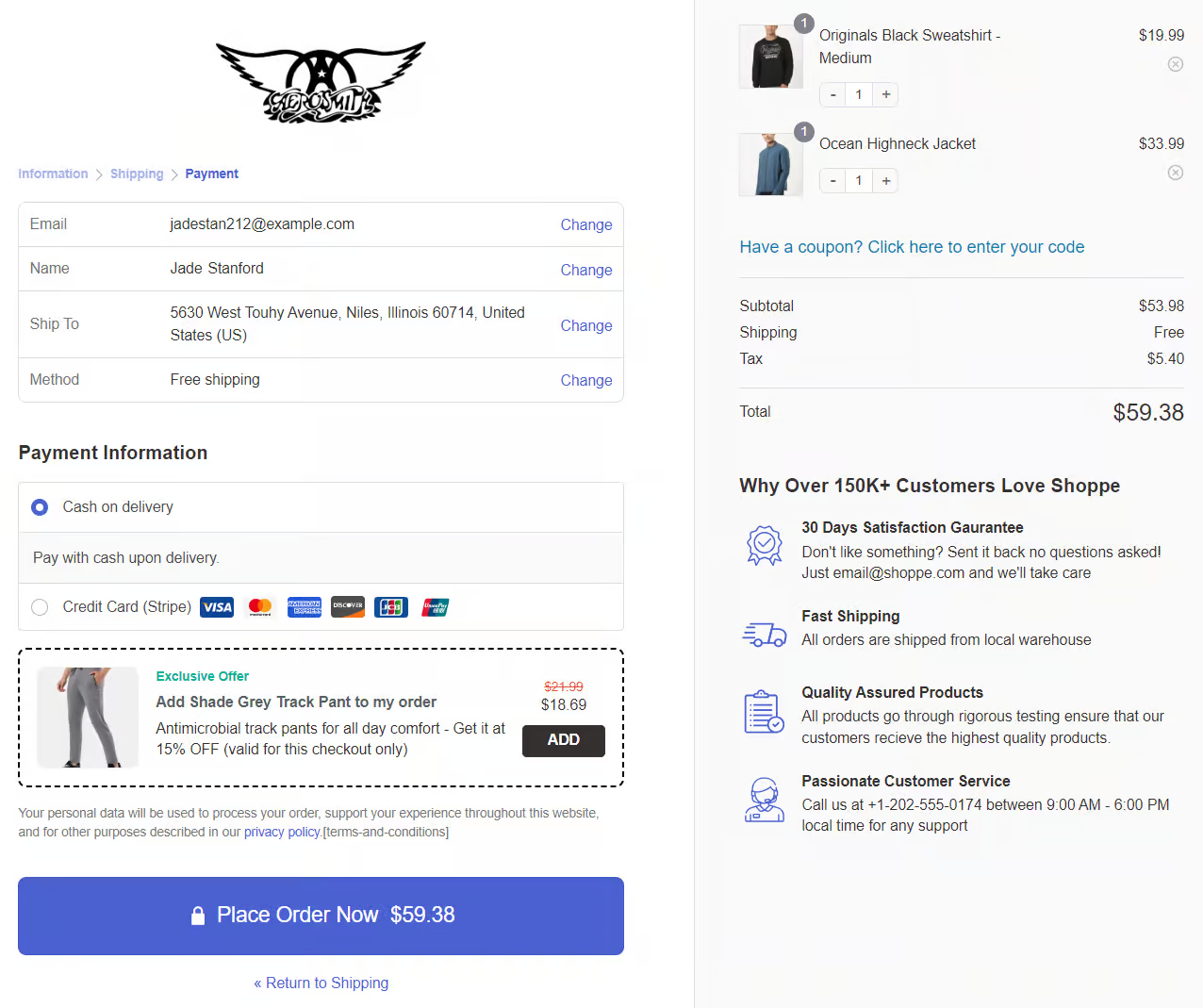

Scroll down below to see the Klarna payment method on the checkout page.

Testing WooCommerce Buy Now Pay Later Payments in Your Online Store

Put your website in the ‘Test’ or 'Admin only test' mode from WooCommerce payment settings to test the Buy Now Pay Later payment method.

Now go to your store and add an item to your shopping cart and head over to the checkout page.

Click on any of the BNPL payment options and hit the place order button.

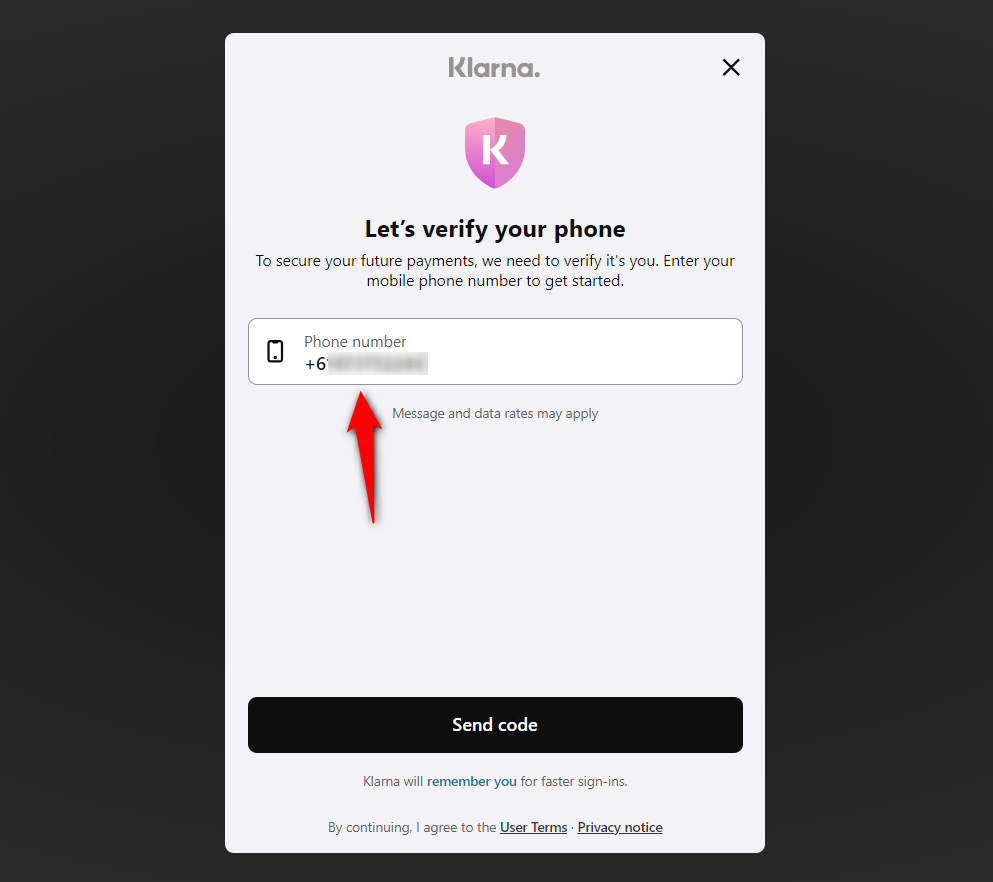

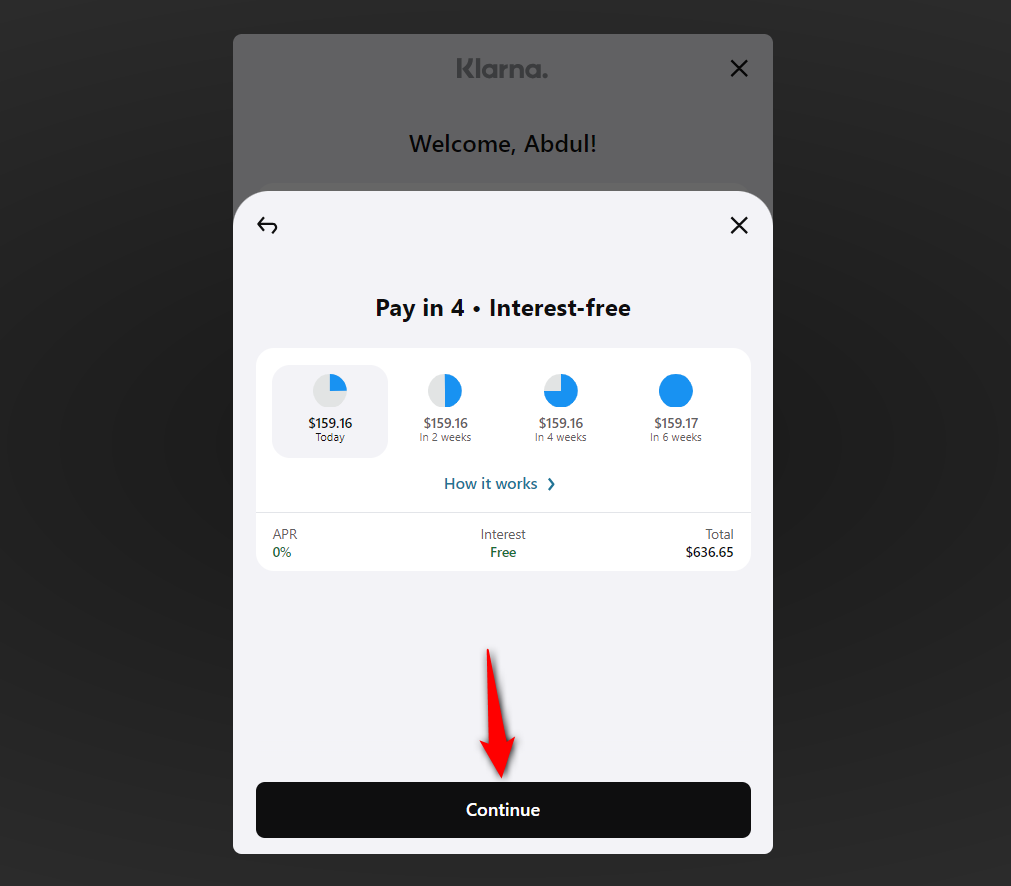

It’ll take you to a popup window to check your BNPL loan eligibility or purchasing power.

Enter your phone number and verify it by entering the 6-digit verification code.

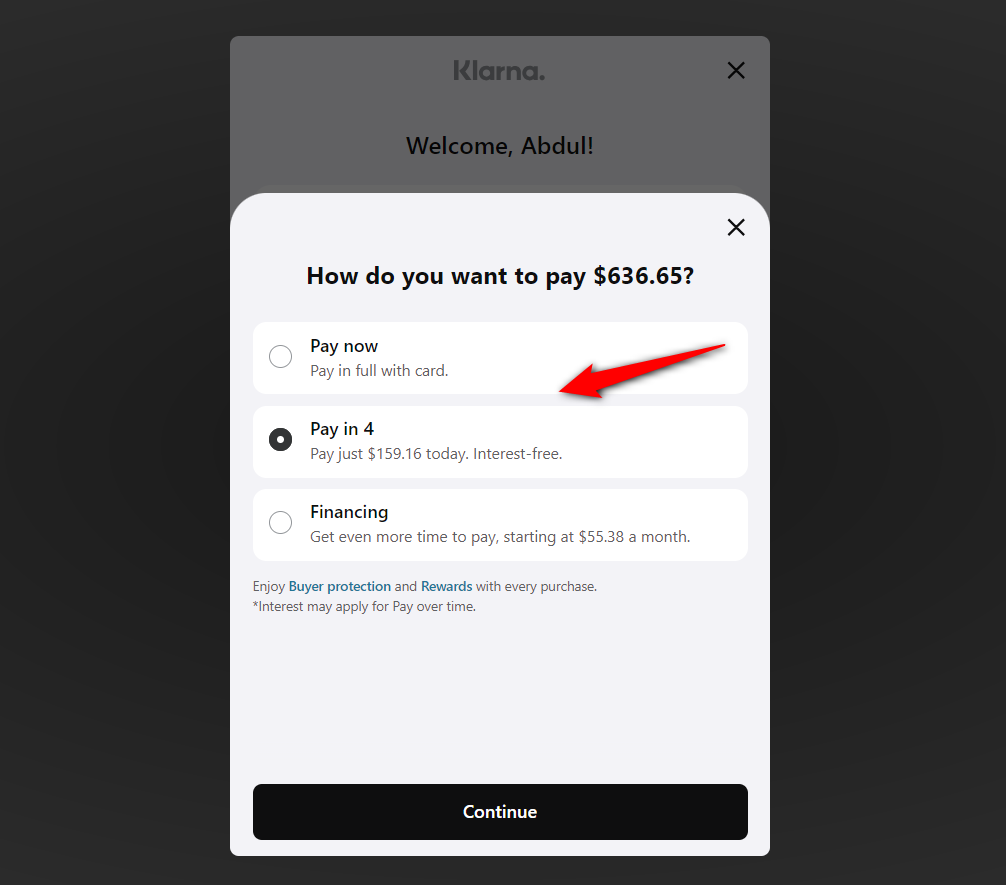

Now, we can choose a payment plan from the available options.

Once you’ve selected the payment plan, it’ll explain the payment that shoppers are needed to pay.

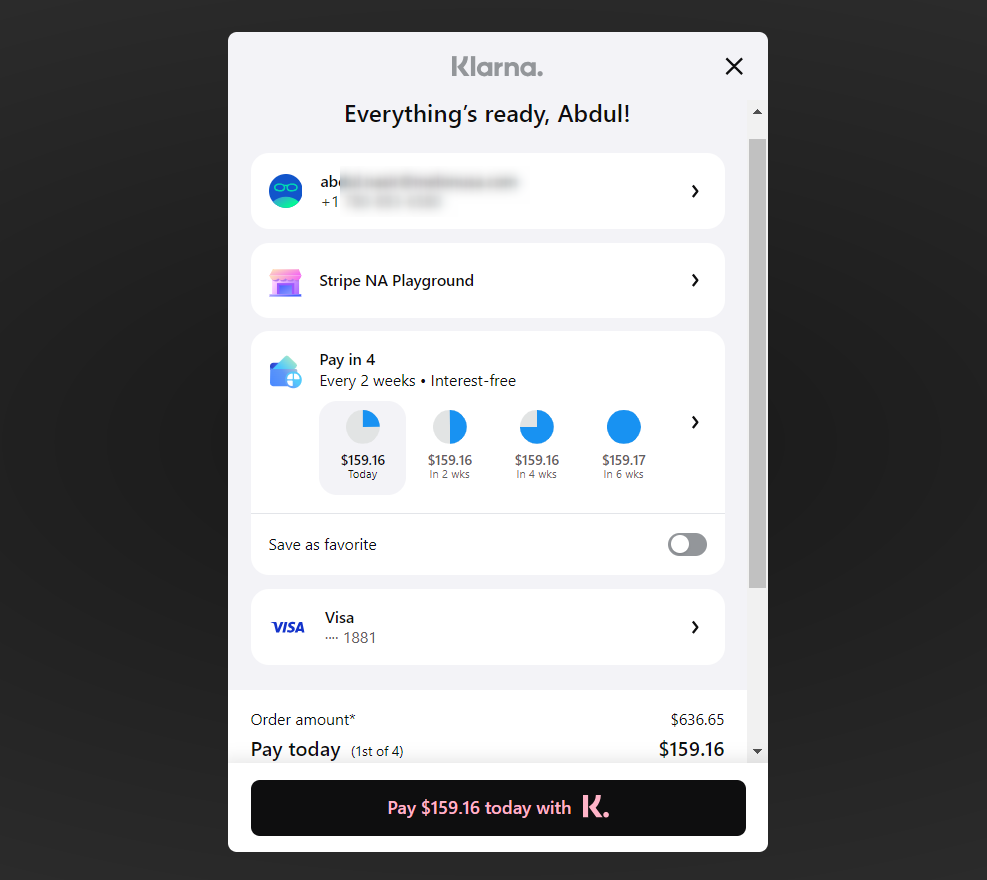

Now, you can review your payment schedule in the final step - this is the amount you’ll have to pay over the coming months.

Once done, hit the ‘Pay today with Klarna’ button to place your order.

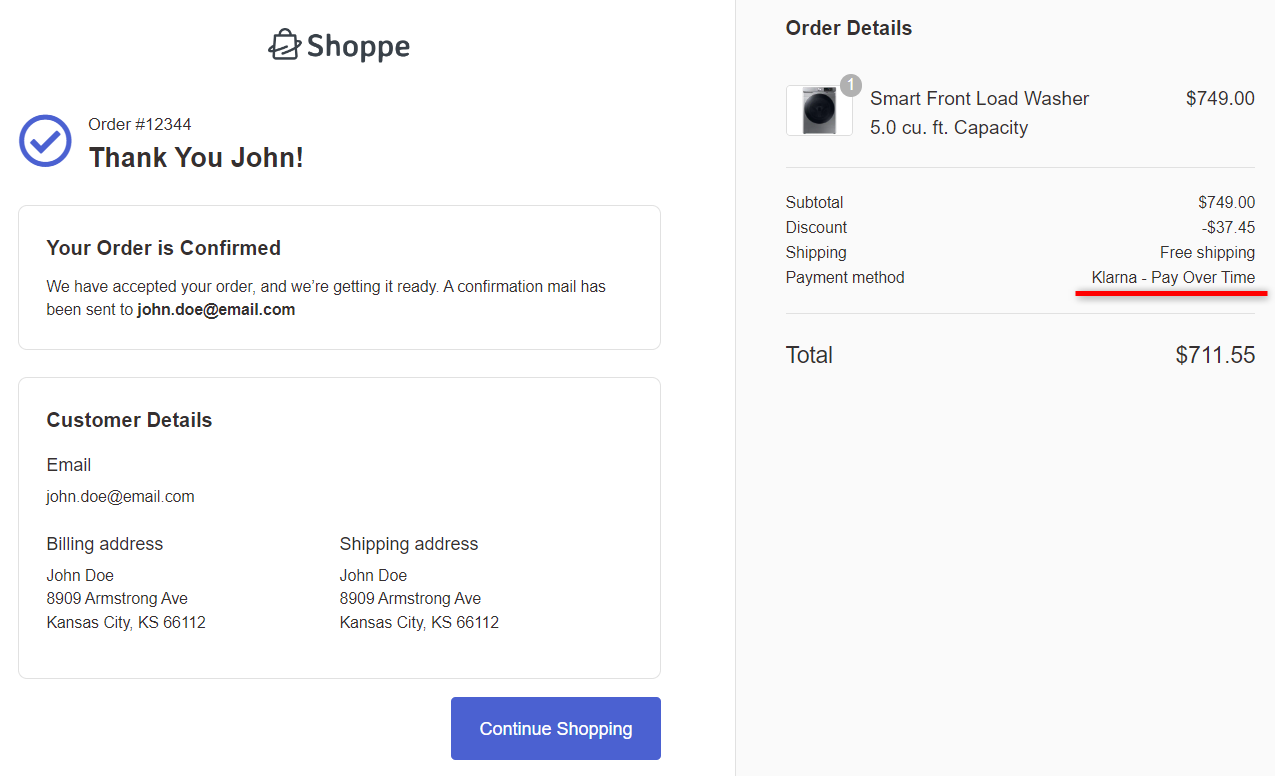

This will place your order and direct you to the thank you page with your complete order confirmation details.

This is how you can test the Buy Now Pay Later payment method in WooCommerce.

Enhance Your WooCommerce Buy Now Pay Later Experience with Custom Checkout Pages

The average conversion rate of a default WooCommerce checkout is 0.3%, which is quite low.

The default WooCommerce checkout page looks dull and isn’t designed for conversions. It focuses only on completing the purchase.

That’s why it becomes quite important to customize your checkout page experience.

You can convert this monotonous checkout experience into a conversion-optimized custom checkout flow.

Wondering how?

Well, you can easily do that with the FunnelKit Funnel Builder that too without any coding knowledge.

FunnelKit Funnel Builder is the most powerful sales funnel builder solution for WordPress and WooCommerce. You can create opt-in pages, sales pages, custom checkouts, order bumps, one-click upsells, and thank you pages.

It has the most advanced WooCommerce checkout manager that allows you to customize high-converting checkout pages.

Take a look at the following beautiful checkout page built with FunnelKit:

- Beautiful conversion-optimized templates - FunnelKit gives access to an array of pre-designed templates for all pages. You can customize your templates with your favorite page builders, such as Elementor, Divi, Oxygen, Gutenberg, and more as per your needs.

- Style your custom checkout pages - You can create beautiful custom checkout pages the way you want. Create one-page checkouts, multi-step checkouts, Shopify-style checkout pages, WooCommerce order forms, global checkouts, etc., that fit your business requirements.

- Advanced checkout form field editor - Its built-in checkout field editor lets you add a custom field, edit, rearrange, or delete the fields or sections within your checkout form simply with the drag-and-drop functionality. You don’t have to use any custom coding to make changes to your checkout form.

- Auto-fill address completion - The Google address autocomplete feature works on Google Maps API, simplifying and speeding up the process of entering addresses into web forms. It uses a predictive algorithm that suggests addresses in real-time as shoppers type their shipping address.

- Product recommendations - FunnelKit lets you add product recommendations throughout the shopping journey to boost your store’s AOV. Add upsells inside the shopping cart, on the checkout page, after the checkout page, and even in emails.

Further, there are 22+ optimizations such as auto-apply coupons, smart customer login, mobile checkout, multi-step field previews, etc. that you can implement on your checkout page to process quick payments and boost conversions.

WooCommerce Buy Now Pay Later: Frequently Asked Questions (FAQs)

Here, we’ve answered some of the commonly asked questions about BNPL payment methods.

1. Does WooCommerce allow payment plans?

No, WooCommerce, by default, doesn’t offer the option to add payment plans to your store. However, you can use a payment plugin like Stripe Gateway for WooCommerce plugin that integrates different payment methods and offers them to your customers.

2. How do I add Buy Now and Pay Later in WooCommerce?

This answer is similar to different questions like ‘How do I set up pay later?’ or ‘How do I set up a payment plan in WooCommerce?’.

To add Buy Now and Pay Later to WooCommerce, you need a Stripe account and a WooCommerce Stripe gateway plugin installed on your website. Connect your Stripe account and enable BNPL payment methods in your WooCommerce store.

3. Can you use Afterpay with WooCommerce?

Yes, you can use Afterpay with WooCommerce easily with the Stripe Gateway for WooCommerce plugin by FunnelKit. Check our complete WooCommerce Afterpay guide here.

4. How do I add PayPal pay later to WooCommerce?

You can install the WooCommerce PayPal Payments plugin on your website. Configure it on your store and enable the pay later on your WooCommerce checkout page.

5. What are the payment options in WooCommerce?

WooCommerce is the most flexible e-commerce platform that supports a wide range of payment options:

- PayPal

- Stripe

- Square

- Authorize.Net

- Amazon Pay

- Apple Pay

- Google Pay

- Bank Transfer (BACS)

- Cash on Delivery (COD)

- Cheque Payment

- Payment Gateways via plugin extension

6. What is the installment payment plugin for WooCommerce?

The best installment payment plugin for WooCommerce is the Stripe gateway plugin for WooCommerce. It integrates with Stripe to enable BNPL installment payment methods such as Affirm, Klarna, and Afterpay.

7. Which is the instant payment gateway for WooCommerce?

The instant payment gateway for WooCommerce is the one-click checkout payment methods such as Google Pay and Apple Pay.

8. Are there any risks associated with Buy Now Pay Later?

While Buy Now Pay Later offers massive benefits to customers and merchants, lenders should know the potential risks associated with customers paying for purchases over time. Furthermore, merchants should be aware of the refunds once the BNPL payment is approved.

9. Can customers use Buy Now Pay Later for all purchases?

The availability of Buy Now Pay Later may vary depending on the merchant and eligible products being purchased.

10. Is Buy Now Pay Later available worldwide?

Yes, Buy Now Pay Later payments are increasingly becoming available globally. However, its availability may vary on the region and BNPL payment provider.

If you have any other questions, feel free to ask our Support team and we’ll surely assist you.

Set Up WooCommerce Buy Now Pay Later Payments and Boost Sales in Your Store!

Overall, WooCommerce Buy Now Pay Later is a powerful tool for e-commerce businesses looking to drive sales and enhance the customer experience.

Offering BNPL options can be a game changer for merchants to enhance their competitiveness and drive growth.

By understanding the benefits, risks, and best practices associated with BNPL, you can position your business for long-term success.

In addition, you can implement strategies such as designing custom checkout pages and streamlining the checkout process, which can help you stay ahead in the competitive market.

That’s why we recommend you get your hands on the FunnelKit Funnel Builder.

It’s a must-have tool to grow your WooCommerce business and generate massive profits.

The post WooCommerce Buy Now Pay Later: How to Enable Affirm, Klarna and Afterpay Payments in Your Store appeared first on FunnelKit.